Proficator aids people in learning about investments by linking them with educational resources. It strives to support individuals in establishing a strong investment knowledge base by connecting them to financial education providers. With Proficator, individuals can enhance their understanding of investment and its complexities.

Proficator is a website designed to help people grasp financial concepts and try to achieve their money goals. It brings together individuals at all levels of financial literacy with tutors who offer tailored training. Through Proficator, users can access personalized education to enhance their financial understanding and skills.

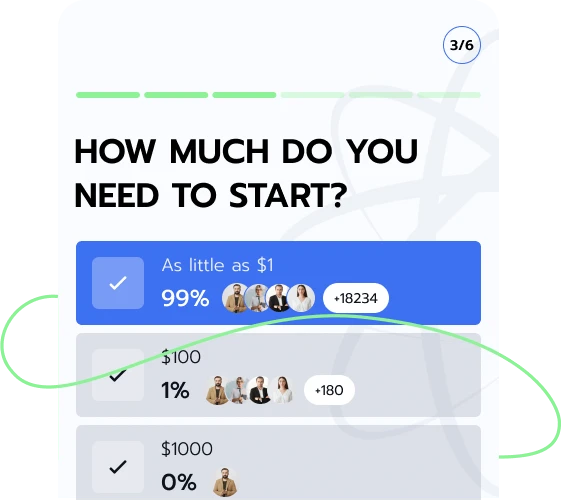

The investment education companies available via Proficator offer users an education for a knowledgeable investment path. Plus, registering on Proficator is cost-free, enabling everyone to start their investment education without financial obstacles.

After signing up on the Proficator, an investment education firm representative will contact the individual for onboarding. Proficator connects users with education firms available to address their inquiries and assist them along their learning path.

To begin, head to the main page of Proficator. Look for the straightforward registration box at the top or click any 'Register' link. Provide precise details in the registration form to start the process.

Upon signing up for Proficator, the investment education firms are set to assist the new user. A representative will inquire about the user's knowledge level and interests, tailoring the learning experience to suit their preferences and requirements.

A new user might have questions before starting. The representative from the investment education companies linked with Proficator will clarify the upcoming journey through a brief phone call. They aim to ease uncertainties and offer insight into the forthcoming learning experience.

Also, the representative will pose questions to the user. This chat aims to figure out how to tailor their learning experience. The beginning stage for someone skilled in investing will differ from that of a beginner.

Proficator functions as a link, joining people keen on learning about investing with investment education providers. Proficator plays the middleman in helping make this connection happen.

Whether someone is new to investing or has some experience, Proficator links them with an investment education firm for a suitable learning experience. Proficator facilitates the user's connection, leaving the rest of their experience to the investment education provider.

Learning happens at the user's pace and convenience. After signing up and logging into the education company’s site, individuals can begin learning whenever convenient.

User-Friendliness and Free Service: The registration process for Proficator is quick and easy, ensuring users promptly connect with investment education firms for a smooth experience. All Proficator services are complimentary.

Individualized Attention and Prompt Response: Upon signing up for Proficator, an investment education company representative will promptly contact the new user. This dedicated contact will offer personalized assistance and insights to enrich one's investment education.

Investing in Initial Public Offerings (IPOs) can be enticing for investors seeking early access to companies entering the public market. Proficator serves as a bridge connecting the investment-curious with investment educators, facilitating informed decisions on IPO investments. Here are some IPO investment concepts individuals interested in investment should know:

IPOs mark the transition of a privately held company to a publicly traded one, offering shares to the general public for the first time. Interested individuals should grasp the intricate process involved, including risks, regulatory requirements, underwriting, and pricing mechanisms.

Thorough examination of the company's prospectus is imperative. It outlines the company's business model, financial performance, risks, and growth projections. Investors need to decipher this document to make informed decisions.

Assessing Management Team

The management team's expertise and track record are pivotal in the IPO. Investors should scrutinize the leadership's experience, vision, and ability to execute strategic plans.

Market Conditions and Timing

Timing is crucial in IPO investments. Investors must evaluate prevailing market conditions, demand for the company's offerings, and overall economic climate to gauge the optimal timing for investment.

Understanding Lock-Up Periods

IPO investors should be aware of lock-up periods, during which insiders and early investors are restricted from selling their shares. Understanding these restrictions is essential for evaluating short-term price volatility.

Proficator connects curious individuals with investment education firms, where they discover more about IPO investment concepts and principles.

While IPOs offer the allure of early-stage investment opportunities, adopting a long-term perspective may be essential. Assessing company fundamentals, competitive landscape, and possible growth beyond the initial offering is often emphasized.

Proficator recognizes that understanding investor behavior is key to making informed choices in the market. That's because investor psychology plays a crucial role in shaping investment decisions. Thus, investors should acknowledge the impact of emotions such as fear and greed on their investment strategies, as these can lead to impulsive decisions.

Moreover, cognitive biases, such as confirmation and herd mentality, can cloud judgment. Proficator connects individuals with educators who can help them recognize and mitigate these biases through tailored educational resources. By understanding investor psychology, individuals can make rational investment decisions aligned with their long-term financial goals.

Additionally, market sentiment often fluctuates based on collective investor behavior. Proficator enables individuals to access insights into navigating volatile market conditions. Recognizing the influence of investor psychology may allow individuals to adopt a disciplined approach to investing, focusing on fundamentals rather than short-term fluctuations. Through continuous education and awareness of psychological factors, investors may enhance their investment strategies.

Proficator recognizes that investment education is crucial for individuals navigating the complexities of financial markets. One pertinent topic is "The Impact of Fees on Investment Returns." Fees can significantly erode possible investment gains over time, making it essential for investors to comprehend their impact.

Fees, albeit seemingly minor, can significantly diminish possible investment gains over time. Below are some standard intricacies of fee structures and their profound effects on investments, shedding light on crucial considerations:

Investors must grasp the nuances of fee structures, encompassing management fees, trading commissions, and expense ratios, to comprehend their impact on investment returns. Understanding these fees empowers investors to make informed decisions.

Even seemingly insignificant fees can compound over time, significantly diminishing the overall possible returns of an investment portfolio. Awareness of the cumulative effect of fees underscores the importance of minimizing expenses to try and maximize the net returns on investments.

Evaluating fee structures across different investment products and platforms allows investors to identify opportunities that offer competitive rates. By comparing costs, investors can strategically allocate resources to options that align with their financial goals and objectives.

Investors can proactively explore negotiation options and seek out investment products with lower fees. Implementing negotiation and reduction strategies may enable investors to mitigate unnecessary expenses and optimize returns over time.

Investment education offers possible advantages to individuals seeking to navigate the complex world of finance. Investors gain essential knowledge about various investment vehicles, strategies, and market dynamics through structured learning. With Proficator as the intermediary connecting people to investment education firms, individuals can access curated content tailored to their needs, equipping them to make informed investment decisions.

Moreover, investment education may instill confidence in investors, equipping them with the tools and skill set to analyze market trends and assess risk. By understanding fundamental principles and staying abreast of market developments, investors can adapt their strategies to changing economic landscapes.

In investing, recognizing the existence of ever-present risks is paramount. Investors often face uncertainties and market fluctuations that can lead to significant losses. However, by implementing suitable strategies, individuals can try to minimize risks to protect their investments against adverse market conditions.

Diversification across various asset classes and sectors is a popular way of mitigating investment losses. Moreover, a disciplined approach to investment management is crucial. Setting clear investment goals, establishing risk tolerance levels, and adhering to a defined investment strategy may help investors stay focused during periods of market volatility. Proficator presents an education-first approach to investing, connecting individuals with educators for informed investment decisions.

While investment losses are an inherent part of the financial landscape, investors can utilize Proficator's connection for education on risks, risk assessment, and risk management. Luckily, registration is easy and free for everyone to kick-start their investment education with Proficator's assigned educators.

Understanding investment risk is crucial for investors seeking to navigate the complexities of financial markets. Risk is an inherent aspect of investing, and comprehending its various forms is essential for making informed decisions. Below, we explore six types of investment risks that individuals may encounter in their investment journeys.

Market fluctuations can lead to declines in the value of investments.

This risk arises when issuers of bonds or other debt securities default on payments. Investors must assess credit quality to mitigate credit risk.

Investments denominated in foreign currencies are subject to currency fluctuations.

Systematic risk affects the entire market and cannot be eliminated through diversification alone.

Also known as "specific risk," non-systematic risk pertains to risks specific to individual companies or industries. Investors may mitigate non-systematic risk through diversification and thorough research into individual investments. Proficator links to investment educational companies to help investors understand both systematic and unsystematic risks.

Liquidity refers to the ease of buying or selling assets without significantly affecting prices. Proficator connects interested persons to education firms that educate them further on this subject matter.

Investment education is a cornerstone of informed investing, and Proficator makes it more accessible. Through Proficator, individuals gain access to educators who provide educational resources and training, empowering them to make informed investment decisions.

Anyone can register for free on Proficator's website for a deeper understanding of market dynamics.